If you were to make a list of industries with solid, almost guaranteed returns, that would have longevity and high ROIs, you'd probably find tobacco pretty high up the list. It would certainly be rubbing shoulders with oil, alcohol, and weapons manufacturers as an industry that seems resistant to all manner of regulatory and economic change.

Of course, we know that this traditional view no longer really holds. It's only really inertia that keeps it on top: that, and addiction. The treatment of tobacco dependency has also been traditionally a big business that is pretty profitable and reasonably easy to get into, if competitive by nature.

A quick search returns around 16.5 million results for the single exact phrase "stop smoking", and about 2.3 billion on a loose match that would probably also take into account "quit smoking", "give up smoking" and other assorted related phrases.

Talking of which, scrolling down to the "Related searches" section of the first SERP throws up some interesting keyword modifiers, qualifiers and indications of intent:

- how to stop smoking immediately - the marketer's favourite: identification of pain, request for a solution, and probably credit card in hand;

- how to stop smoking naturally - again, a clear sense of urgency and differentiation;

- stop smoking hypnosis - somewhere on their journey, they've found a solution they like;

- free stop smoking kit, stop smoking kit, stop smoking timeline, etc. - all solid indicators that the prospect wants to do something about it and is ready to pay.

Aside from the competitive nature, these are all good flags that you should dig a bit deeper and see if there's some money in the niche. Guess what? There is. According to AdWords, you'll pay around £3 to advertise in this niche, with several tens of thousands of prospects looking for solutions linked only to the phrase "stop smoking".

If we assume a 1% CTR on the sum of all possible biddable keywords, that's around £3,000 per month to reach the market. To me, that shows that it is capable of supporting revenue generation, although it should be noted that the spread is wide. In other words, real advertising spend could be within the range of £8.90 to £3,430 taking into account the lowest traffic at the cheapest bid to the highest traffic at the highest bid.

But there's also another problem.

An Industry In Decline

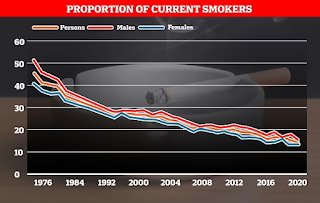

According to the UK's Office for National Statistics, tobacco "usage dropped from 15.8 per cent in 2019 to 14.5 per cent last year" (source: Daily Mail) In fact, the proportion of smokers in the UK has been falling consistently year on year since the 1970s.

|

| Data from ONS, Graphic from the Daily Mail |

The data itself is interesting, and the article in question provides some good insights, but we're more concerned with the overall picture: a 1.3% drop consistent with history, and the lowest proportion of smokers in the population (over 16s only) since the year 2000.

When you're looking for opportunities, it doesn't really matter what causes these drop-offs. In the case of tobacco use, everything from advertising, to the reduction of screen time showing smokers in soap operas, rising cost, and the effect of lockdowns will contribute.

No, our primary interest is in checking that the decline of the industry isn't likely to cause a similar decline in the size of the opportunity. We're after some kind of corroborative effect, or, better, proof that the "stop smoking" market is effectively immune to the decline of the smoking population.

Sadly, it isn't.

Collateral Damage

When an industry declines, there is often, some kind of collateral damage. The little self-help industries that grow up around very specific addictions (from texting, to sex, drinking to smoking and everything in between) are usually the first to suffer.

To try and figure out if these declines are affecting an associated market, it is useful to carry out trend analysis, paying specific attention to:

- reduced seasonal spikes;

- general downward movement;

- closer proportions between competing search terms.

Any of the above is a red flag. With that in mind, here's the 2004 - 2021 trend line for the three leading competing search terms for the quitting industry linked to tobacco use:

|

| Search Trends since 2004 for the UK |

Ouch.

First flag: look at those seasonal spikes between 2004 and 2016. Each of those peaks is in January, and I would associate that with one thing - New Year's Resolutions to finally kick the butt. Whereas that swing was huge in the early 2000s, in the late 2010s, it has become much less marked.

Second flag - a downward trend across all three terms. Although close to levelling out, the decline is marked and roughly follows the 1.3% by volume due to the effect of reduced seasonality.

The final flag is the fact that the gap between the lines has narrowed. There's no longer a clear leader (like the red line over the yellow line in 2004-2010). No, as we wend our way towards 2022, those three lines are closer together than ever before.

If I had a client whose bread and butter was the "stop smoking" market, I'd be telling them to pivot and pivot hard, into finding another addiction to cure. Of course, I'd have to help them find an alternative, using strategic keyword research, but that's for another time.

If you'd like to find out if your industry is in danger of declining away from you, then leave me a comment below and I'll be in touch. Or, you can tweet me (@gwleckythompson) or look me up on Facebook.